Wharton Equity Launches E-Commerce Industrial Platform

Wharton Equity Launches E-Commerce Industrial Platform

Developing 1 Million SF Warehouse/Distribution Facility in Atlanta

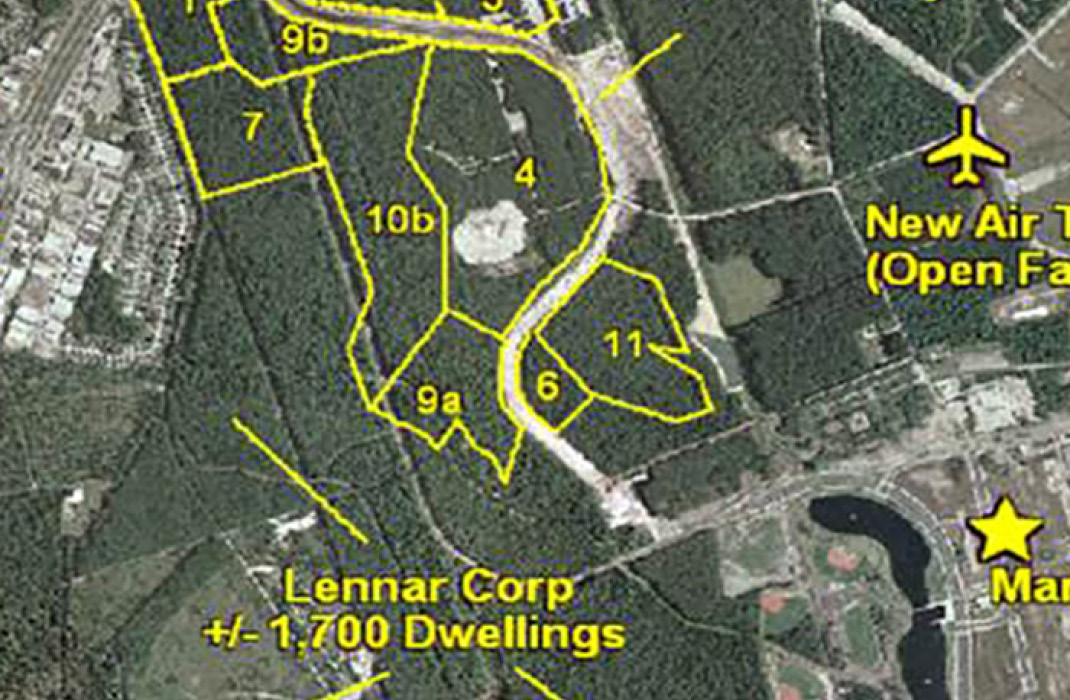

NEW YORK/PRNewswire/ — Wharton Equity Partners announced today the launch of its e-commerce industrial platform, Wharton Industrial, with the acquisition of an approximately 80-acre parcel of land in Atlanta. The property, which will be developed with a 1 million square foot warehouse/distribution facility is part of Shugart Farms, a master-planned industrial development with the potential of up to 14 million square feet. The project is a joint venture among Wharton Equity, Red Rock Developments, the Shugart family and a large real estate private equity firm. The Shugart family has owned the over 2,000 acres comprising Shugart farms for more than 50 years.

“We have been studying the effects that e-commerce is having on the logistics and distribution business and made a strategic decision to launch a major initiative to capitalize on what we believe will be significant opportunities in the many years ahead,” noted Peter C. Lewis, a founder and President of Wharton Equity. “It is our intent to build in excess of 10 million square feet over the next couple of years. In addition, we are keenly focused on acquiring obsolete warehouses around major cities and repositioning them into state-of-the-art properties that will attract “last-mile” users,” Lewis added.

The company will be concentrating on the primary and secondary markets in the US where it can develop buildings generally greater than 500,000 square feet, and which will appeal to users seeking Class A space. For its value-add properties, Wharton Equity will be targeting the top 25 MSA’s where the demand for real-time delivery is becoming a top priority of retailers.

Wharton Equity’s move into e-commerce warehouses is consistent with the firm’s history of identifying secular changes and moving quickly to develop significant businesses around these nascent trends. For instance, in 2012, sensing the pent-up demand for multifamily housing, Wharton Equity aggressively began acquiring value-add properties in the southeast US, and purchased $400 million of assets within 3 years.

“One of the great joys of my career has been the ability to proactively seize opportunities around big ideas before they become apparent to the investment community at large,” says Lewis. “It has been very rewarding that this pioneering approach, which is often lonely, has resulted in out-sized gains for our partners over the last 30 years.”

Wharton Equity Partners, formed in 1987 and with offices in New York City and Miami, is a diversified real estate sponsor with deep hands-on operating experience across various real estate assets and strategies. The firm serves as a holding company for a suite of real estate businesses, including Wharton Residential, Wharton Industrial, Wharton Hospitality and Wharton Urban, and has been involved with well in excess of $1 billion in transactions since inception.

Jack Wolff

Jack Wolff Gary Korn

Gary Korn Nicholas Aileo

Nicholas Aileo David E. Eisenberg

David E. Eisenberg Adam E. Krupp

Adam E. Krupp Ilaina Sperling

Ilaina Sperling