Wharton Equity Partners

Real estate investing and capital preservation

Adam E. Krupp

Adam E. KruppMr. Krupp is responsible for capital formation, strategic joint venture partnerships, and spearheads Wharton Digital Ventures’ Data Center platform. During his over 35-year career, Mr. Krupp has been involved in all facets of real estate, including acquisition, development, construction, leasing, asset management, and capital raising. Working both entrepreneurially and with well-established firms including Waterton Residential, CS Technology, Grubb & Ellis, and The Glick Organization he has been involved with the acquisition and development of over $3 billion worth of properties across a broad array of asset classes.

As pertains to WD’s Data Center vertical, Mr. Krupp brings 15 years of experience in the siting, design and construction of high reliability and sustainable mission critical data centers for some of the world’s largest financial services and technology companies including Bank of America, AIG, Digital Realty Trust and CRG West (the predecessor of CoreSite). He has been instrumental in the firm’s acquisition and development of both utility power and “behind the meter” data center projects ranging from 80MW to 1.3GW.

Mr. Krupp received his Master of Science in Real Estate Development & Investment degree from New York University’s Shack Real Estate Institute, and his Bachelor of Arts from the University of Michigan, Ann Arbor.

Nicholas Aileo

Nicholas AileoMr. Aileo is responsible for sourcing, underwriting and executing on the firm’s industrial acquisitions. Before joining the company, he was an Analyst at Saxum Real Estate, where as a member of the acquisitions team, he was responsible for underwriting acquisition and ground-up development opportunities across all asset classes, with a particular focus on industrial, office, and multi-family. Prior to that, Mr. Aileo worked as a financial analyst for Avison Young. Mr. Aileo received his Bachelor of Business Administration from Villanova University.

Fabric is a pioneer in the automation of urban warehouses which are critical in meeting the growing demands of consumers seeking same day deliveries. By combining highly efficient fulfillment systems with local last-mile locations, Fabric is redefining how supply chains work. The company has developed its own proprietary AI software and robotic technology and is running micro-fulfillment operations for grocery and general merchandise retailers in New York City, Washington, DC, and Tel Aviv. Fabric maintains partnerships with major retailers and grocers including Walmart, Instacart, FreshDirect and others. As a key piece of its longer term strategy, Fabric is seeking to buildout a “neural network” of automated microfulfillment centers throughout the US to be able to offer a national footprint for customers.

Wharton was part of a $200 million Series C round that valued the company at approximately $1 billion and which featured other investors such as Temasek, CPP Investments and Koch Disruptive Technologies. Proceeds from the round will be used to assist Fabric in expanding its base of warehouses nationally, adding key executives and further developing its hardware and technologies.

80-100MW Data Center Development, Midwest

Wharton Digital is going through approvals for the development of an approximately 80-100MW data center in the Midwest (confidential location). The 26-acre site is owned by the municipality which also owns the power utility. ~60% of the power delivered to the building will be hydroelectric. Consistent with our goal to support the next generation of technology buildings the data center is being designed as a 2-story, high-density facility to support mission critical AI and high-performance computing (HPC) workloads within a Tier III/IV design configuration. Discussions have already commenced with a number of prospective tenants interested in occupying the building.

This property is emblematic of the type that WD will be pursuing, as the site has available power with green elements, is in a pro-business government environment, and at the heart of major data center markets.

Mr. Lewis is Chairman, President and Founder of Wharton Equity. Since its inception in 1987, he has overseen the expansion of the firm’s investment reach across different asset classes and strategies. As Chairman of the Real Estate Investment Committee, Mr. Lewis drives the direction of the firm as it executes its disciplined strategy of recognizing and capitalizing on emerging trends.

Among other initiative over the course of his leadership of Wharton Equity, Mr. Lewis established the firm’s industrial, multifamily, self-storage, homebuilding, hospitality and venture capital platforms resulting in $2.5 billion of transactions.

Mr. Lewis has had a diverse career having been employed in investment banking, commercial banking and tax accounting prior to forming Wharton Equity. Besides his real estate activities, he is an active venture capital and private equity investor. Mr. Lewis received his Bachelor of Science degree in Economics from the Wharton School at the University of Pennsylvania and his Master in Business Administration from the Graduate School of Business at Columbia University. He is a frequent guest lecturer in real estate, and is involved in a number of philanthropic endeavors.

Mr. Uretta is responsible for the day to day administrative and operational functions of the firm, as well as being involved in investment decisions. Prior to joining the company, Mr. Uretta held a number of senior C-Suite level positions including Director of Risk Management for CIII Capital Partners and CFO & COO of Insignia Financial group, a NYSE company with over 12,000 employees and over $1 billion in gross revenues.

Mr. Uretta received his Bachelor of Business administration in Accounting and Business at Waynesburg University. Among his many philanthropic endeavors, he is a trustee of the New York State Troopers Signal 30 Fund for Children’s Medical Support and has been a mentor at NYU’s Stern School of Business in Entrepreneurship and Innovation.

Gary Korn

Gary KornMr. Korn, a member of Wharton Equity’s investment committee, is responsible for overseeing the sourcing and execution of transactions, including spearheading the firm’s due diligence efforts. Mr. Korn began his career as a corporate and real estate attorney working at the firms Cravath, Swaine & Moore and Fried, Frank, Harris, Shriver & Jacobson. In 1993, Mr. Korn co-founded Korn & Katz, LLC, where he led the development, acquisition and investment in single and multi-family residential communities, shopping centers, industrial parks and commercial office buildings. From 2008 through 2012, Mr. Korn was a joint-venture investment partner with Charter Realty & Development. In addition to his involvement in real estate, he has been an active corporate entrepreneur having founded and sold a specialty finance company, Rexford Funding, and served a key role in the growth of ServiceChannel, a facilities management software company.

Mr. Korn received his Bachelor of Arts degree from the University of Pennsylvania and subsequently graduated with the highest academic honors from Cornell Law School. He also received his Masters in Business Administration from the Wharton School at the University of Pennsylvania.

Ilaina Sperling

Ilaina SperlingMs. Sperling is involved with asset management of the firm’s properties, focusing on maximizing the property values. Responsibilities include implementation of business plans, analyzing financial performance, proposing goals and objectives for each asset and ensuring these are met, and reporting to and interfacing with investors and lenders. Ms. Sperling attended the University of Wisconsin and received her Bachelor of Science degree in Marketing from Montclair State University. She also holds a Master of Science in Business Management from the City University of New York.

Teddy Lewis

Teddy LewisMr. Lewis is responsible for underwriting and executing on the firm’s acquisitions and development projects. Before joining the company, he was an Associate at Arel Capital, a real estate private equity firm, where he was responsible for assisting in acquisitions underwriting and sourcing for both equity and credit. Mr. Lewis received his Bachelor of Science in Economics from the Wharton School at the University of Pennsylvania.

Jack Wolff

Jack WolffMr. Wolff is responsible for underwriting and executing on the firm’s industrial acquisitions. Before joining the company, he was a Real Estate Lending Analyst at Greystone & Co., Inc, where he was responsible for sizing commercial real estate loan transactions as well as preparing initial financing terms and issuing loan applications. Mr. Wolff received his Bachelor of Arts in Economics from Amherst College where he played Varsity lacrosse for four years and was a two-time member of the NESCAC all-academic team.

David E. Eisenberg

David E. EisenbergMr. Eisenberg is Co-Founder of Wharton Equity and President of Wharton Companies, an affiliate real estate company located in Miami. In his capacity, Mr. Eisenberg is responsible for overseeing the sourcing, underwriting, development, and deal execution of properties in South Florida.

During his career, Mr. Eisenberg has been active in real estate, venture capital and private equity. Prior to Wharton Equity, he founded and ran several successful operating businesses.

Mr. Eisenberg received his Bachelor of Science degree in Management from the A.B. Freeman School of Business Administration at Tulane University and attended the New York University Graduate School of Business Administration. Mr. Eisenberg resides in Miami where he is involved in various philanthropic endeavors.

Wharton Urban purchased a prime 1.8-acre site in the town of Bay Harbor Islands, a submarket of Miami, Florida, for the development of a significant mixed-use project that will contain office, retail and residential components. The property was acquired off-market from a family that owned the site for over 20 years. After an extensive process, world-renowned architectural firm, Arquitectonica, was chosen to design the project. Wharton Urban is partnering with Northwood Ravin, a major real estate private equity firm, on the development.

Wharton Urban acquired a note from a large bank secured by a 2.2 acre parcel of land in downtown Miami. The site is zoned for a 2 million square foot mixed use development project, and has plans previously developed by internationally-acclaimed architect, I.M, Pei. Wharton Urban’s partner on the transaction is a leading global hedge fund. The note was acquired “all cash” with 100% equity, and the closing occurred in under 30 days. Approximately four months after the acquisition of the note (two years ahead of schedule), Wharton Urban negotiated a deed-in-lieu-of-foreclosure and acquired unencumbered; fee simple interest to the property.

Wharton Urban, in partnership with the Mack Real Estate Group, completed the development of an approximately 500,000 square foot, 18-story mixed-use development project at the nexus of Midtown, Wynwood and the Design District in Miami. The property contains 194 residential units, with such amenities as dog-walking areas, deck-top pool, health club facility, and social lounges. In addition, there is over 65,000 square feet of retail space at the base of the building. Consistent with all Wharton Urban projects, the property has a distinctive design which was formulated in conjunction with the property’s architect, Stantec.

Wharton Urban played an integral role in developing an approximately 20,000 square foot “high-street” retail property located in Miami’s Design District. The building, designed by award-winning Touzet Studios, has 30-foot high glass storefronts, with a second floor that “floats” above Interstate 195. Wharton Urban secured the key tenant for the building, Sub Zero Wolf, which chose the property for its southeast showroom and has leased the entire second floor where it will be installing elaborate demonstration kitchens in its space, as well as the rooftop. Neighbors of the property include such super luxury brands as Prada, Gucci, Louis Vuitton, Channel and Hermes. Located at the gateway to the Design District on NE 2nd Avenue, the building serves as a distinctive anchor to what is quickly emerging as one of the world’s great shopping destinations.

Wharton Hospitality, in partnership with Hersha Hospitality Management and a New York City private equity firm, facilitated the acquisition of the 405-room Sheraton Miami Airport Hotel. The property is the closest hotel to the Miami International Airport and has direct access to the recently opened Miami Intermodal Center, which provides direct connections to South Beach, Brickell and other regional leisure and business destinations. The hotel has 17,000 square feet of meeting and event space, and guests also have access to a 1,800 square foot fitness facility and several food and beverage outlets. The partnership completed a full upgrade of the guest rooms and public facilities in coordination with Starwood Hotels (now Marriott).

Wharton Hospitality, in partnership with an institutional capital partner, engineered the purchase from The Blackstone Group of an approximately 600,000 square foot mixed use project located in Lexington, KY. The complex, on a prime downtown corner adjacent to the Lexington Convention Center, consists of a 365-room, full service hotel and a 250,000 square foot office building. Wharton Equity negotiated the re-flagging of the hotel from a Radisson to a Hilton, and implemented a $15 million property renovation, including a complete renovation of all hotel guestrooms and public spaces. A new 40-foot high mosaic fountain with a horse theme is the centerpiece of the lobby, which was designed by Wharton Hospitality in conjunction with Mixed-up Mosaics based in Soho, New York. Debt financing for the approximately $50 million transaction was provided by an affiliate of Legg Mason.

Wharton Hospitality and an investment partner acquired a 122-room Holiday Inn Express in Montrose, CO from a local lender who gained control of the asset under distress. Wharton Hospitality repositioned the asset through a major renovation and a renewed franchise agreement. In addition, management was changed to Interstate Hotels who embarked on a significant marketing program which increased REVPAR dramatically.

Wharton Residential acquired a 1980’s vintage, 210-unit value-add property located in Antioch, Tennessee, minutes from downtown Nashville. Acquired off-market from the original developer, the exterior, common areas and the majority of apartments were in their original condition. Wharton Residential’s plans call for an extensive overhaul of the property, including replacing siding with HardiPlank, installing a new gourmet outdoor grilling station, a fire-pit, new pool deck, new signage, enhanced landscaping and a gut renovation to the clubhouse. This is in addition to upgrading most of the apartments with vinyl plank flooring, new cabinets and counter tops and enhanced lighting.

“Cedar Pointe fits squarely with our strategy of purchasing assets in growing markets where we can use our 30 years of experience to upgrade the character of a property and provide a wonderful living experience at a great value,” says Peter C. Lewis, President and founder of Wharton Residential.

Following the renovations, Wharton Residential subsequently sold the property and achieved an IRR of over 50%.

In conjunction with a large institutional partner and BH Equities, Wharton Residential acquired a $250 million portfolio of 18 properties. The assets, comprised of over 4,100 units, are being repositioned through a $17 million capital improvement program focused on interior and exterior renovations. Wharton Residential sourced the transaction on an off-market basis, negotiated terms with the seller and coordinated the relevant parties to achieve an expedited closing in 60 days. The properties are located in such high-growth markets as Charlotte, NC, Columbia, SC, Savannah, GA, and Midland/Odessa, TX.

Upon substantial completion of the repositioning of the portfolio, the properties were sold, yielding a gross IRR of 24% and a 1.6x multiple on invested capital.

Wharton Residential acquired a brand new, 326-unit Class A property located in Pooler, Georgia, a highly-desirable sub-market of Savannah, which was in the final stages of lease-up. When the company went into contract, the asset was under 60% occupied and was 80% leased upon closing, evidencing strong demand for Two Addison Place. “Continuing our strategy of purchasing great multifamily properties in growing markets, Two Addison Place is a prized acquisition that we will be proud of owning for years to come,” states Peter C. Lewis, President of Wharton Residential.

Inspired by the architecture of Addison Mizner, architect of The Cloister Hotel in Sea Island, GA and many of Florida’s most luxurious landmarks, the property has red tile barrel roofs, wrought iron balcony railings and stucco siding. Although in first-class condition, Wharton Residential will be enhancing the asset from adding a fire pit and a second gracious fountain, to supplementing landscaping, signage and lighting.

The Preserve at Somers is a 300-acre, $115 million residential community consisting of 188 single-family homes situated on one-half acre lots. Homes in the development were sold out in approximately three years, with price increases moving average starting prices from $400,000 to almost $900,000. Wharton Equity was intimately involved in structuring the acquisition and financing of the property; securing all approvals for the site; overseeing all aspects of construction (homes and infrastructure), and marketing.

Montville Chase is a 317-unit, $42 million residential development project of townhouses and condominiums. The community offers its residents such amenities as a jogging track, clubhouse, pool, tennis courts and children’s play area. Off-tract improvements included the widening and renovation of a nearby bridge, and installation of a one-mile sewer main.

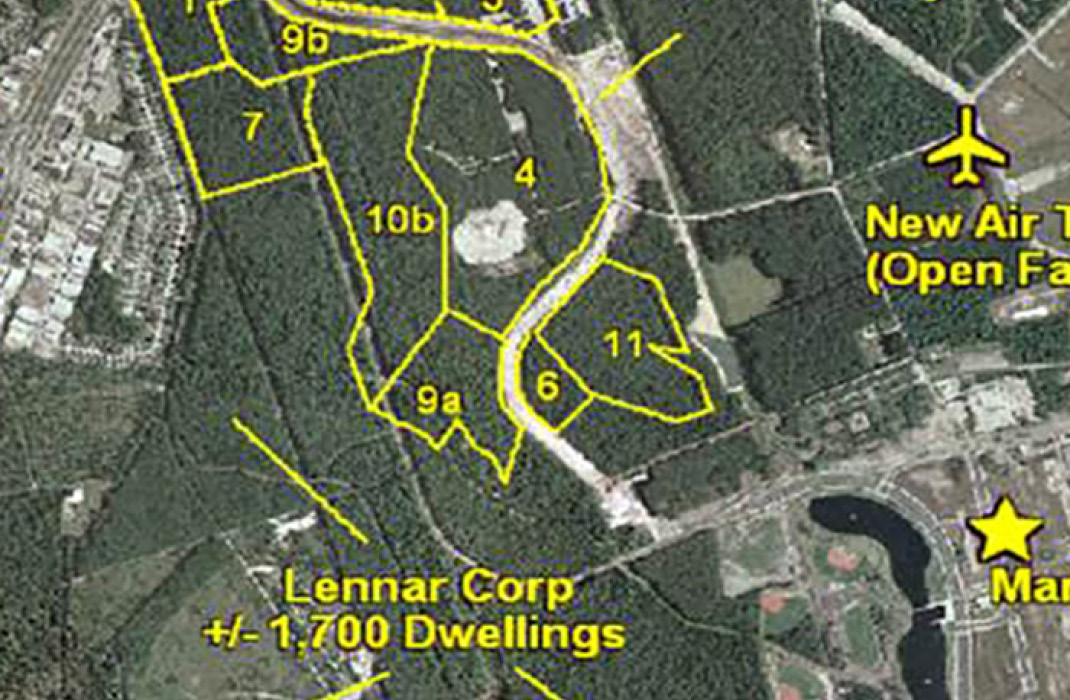

Wharton Residential contracted to acquire a 2.7 million buildable square foot, 304 acre mixed use property located in Myrtle Beach, South Carolina, adjacent to the Myrtle Beach International Airport. The project was approved for approximately 1.2 million square feet of residential development and 1.5 million square feet of commercial development. The property was sold by Wharton Residential for $50 million to an affiliate of Fortress Investment Group prior to development.

Wharton Industrial has begun construction on a $225 million, 100-acre site in Mesa, AZ where it is developing an 11-building, 1.5 million-square foot Class A industrial park known as “The Hub@202.” The buildings will range in size from 65,000 square feet to 270,000 square feet and will feature 28- to 32-foot clear heights; 73 trailer parking spaces; 60-foot speed bays; and 1,429 car parking spaces.

The site is among the last large contiguous land parcels remaining in the area and is centrally located in the highly desirable Southeast Valley submarket of Metropolitan Phoenix — one of the fastest growing industrial markets in the country and poised to lead the nation in industrial rent growth over the next five years.

The project is part of Wharton Industrial’s strategy of making strong conviction investments in markets the company believes are on the cusp of significant growth stemming from the impact of technological change. Mesa squarely fits this profile as it is emerging as the “digital desert” with companies like Microsoft, Google, Apple and Amazon having a strong presence. Moreover, the area is home to other “new age” companies involved in chip manufacturing (Intel and Taiwan Semiconductor), aerospace (Boeing, Lockheed, Gulfstream, Virgin Galactic) and electric vehicles (Lucid).

The HUB@202 is being positioned to cater to firms seeking a presence in the East Valley which are attracted to the strong, skilled labor market in the area and the ease of access to the greater Phoenix area, as well as California and Nevada.

The lead lender on the project is MSD Capital, an affiliate of the family office of Michael Dell.

Wharton Industrial acquired 34 warehouses in Pennsauken, New Jersey from the original developer of the properties in an off-market transaction. The assets are located 15 minutes from Center City Philadelphia and increase the company’s footprint in the market. Given their access to nearly 6 million people in the metro area, the assets serve as a key last mile distribution point for the portfolio’s regional and national tenants such as Nestle, PepsiCo and Sprint.

The properties, known as Twinbridge Industrial Park are in proximity of each other and represent over 30% of the inventory of investor-owned industrial in Pennsauken. Wharton Industrial has completed upgrading the common areas of the property with enhanced landscaping, signage, lighting and to create a new web portal to enhance tenant relations (e.g., service calls, leasing matters). In addition, the firm has undertaken a comprehensive replacement of many of the roofs in the park.

The properties will benefit significantly from the further emergence of Philadelphia as a major hub for distribution on the east coast. Additionally, there has been an increasing migration of tenants from the New York metro area and northern New Jersey to south New Jersey/Philadelphia seeking greater affordability. These factors coupled with the scarcity of available inventory and land for development, portend a continued rise in rents.

Wharton Industrial is partnering with Walton Street Capital on this project and received debt financing from Nuveen.

Wharton Industrial acquired a 283,000 SF warehouse in Philadelphia, PA and immediately commenced a major renovation program to convert the former subway repair facility into a top-tier last mile warehouse. The improvements included removing rail beds inside the facility, replacing the entire roof, leveling interior floors, installing LED lighting, upgrading loading docks, and repaving the parking areas. Wharton Industrial also branded the property, “SoPhi Logistics Center.” Nine months after acquisition, Wharton Industrial was able to secure a 10-year lease with Amazon for the entire building. The company is utilizing the property as a “mission critical” facility for its same-day delivery service.

The Property is strategically located for e-commerce distribution / fulfillment as it is within one hour of 6 million people and one day’s drive of half the US population. In addition, the SoPhi Logistics Center sits at the nexus of I-95, I-76, Center City, the port of Philadelphia, and the Philadelphia International Airport. Wharton Industrial is actively seeking last mile warehouses and believes this asset is representative of the unique opportunities in transforming older industrial assets into modern facilities geared towards the needs of today’s users.

After completing the renovation program and leasing the facility, Wharton Industrial sold the property and achieved a 208% gross IRR on the transaction.

Wharton Industrial partnered with Walton Street Capital on this project.

For our recent marketing video, please click here.

Wharton Industrial signed a 20-year lease for its nearly 1 million square foot development project in Atlanta, GA with PVH Corp., the company behind clothing brands including Calvin Klein and Tommy Hilfiger. The recently finished building, which sits on over 80 acres and was leased prior to completion, was developed by Wharton Industrial, Red Rock Developments and an affiliate of Starwood Capital Group.

Located immediately south of downtown Atlanta, the property is strategically situated in proximity of key modes of transportation including the CSX rail intermodal, the Hartsfield Jackson International Airport, and interstate highways I-85 and I-75. Neighbors of the project include Duracell, Clorox, Smuckers, and Google.

Shortly after completion the property was sold to a REIT, yielding a gross IRR of nearly 30% and a 2x on invested capital.

Foreseeing the strategic importance of Ocala, FL with respect to its location and proximity to labor, Wharton Industrial acquired a 46-acre parcel of land in the market and developed a 617,000 SF state-of- the-art warehouse / distribution facility. Prior to the completion of the project, the firm signed a 10-year lease with Amazon for the entire building.

Ocala is the Northern Apex of the Central Florida distribution market on the I-75 corridor, where the project is located. 70% of Florida truck traffic goes through this corridor. The area also benefits from an abundant and qualified labor force, with approximately 600,000 people within a one-hour drive of the property. Neighbors of the project include Chewy.com, AutoZone, and FedEx. Wharton Industrial partnered with Red Rock Developments, and Westport Capital Partners on the project.

Upon completion, the property was sold to a REIT, yielding a gross IRR of 58% and 1.7x on invested capital.

Wharton Industrial purchased the former Office Depot distribution center and negotiated a sale/leaseback for 40% of the building. Upon the acquisition, the firm undertook a capital improvement program which included installing a demising wall to bifurcate the space, repaving the parking area, which included adding a stretch of road to complete a loop around the building, and installing LED lights.

Located in the Humboldt Industrial Park, the property benefits from easy access to Interstates 80, 81 and 76 and a strong labor pool. Further, the building’s 32+ foot clear ceiling heights and ample parking provides unique attributes in the NE PA market which is accessible to over 30% of the US population within one-day’s drive.

Wharton Industrial partnered with CenterSquare Capital Management on the transaction. Upon stabilization, the property was sold to a REIT, yielding a gross IRR of 33% and 1.7x on invested capital

In two separate transactions, Wharton Industrial, in conjunction with an institutional partner, orchestrated the acquisition of two warehouse properties that primarily cater to the fine art and antiques industries. The purchases resulted in Wharton Industrial having a virtual monopoly on the art storage market in midtown Manhattan. A comprehensive renovation program for both properties was undertaken. Debt financing for both acquisitions was provided by Prudential Mortgage Company. Total capitalization of the two transactions exceeded $80 million.

An affiliate of Wharton Industrial, Wharton Storage, in partnership with an institutional investor, acquired a portfolio of approximately 6,500 self-storage units from an affiliate of GE. Located in the New York metropolitan area, the facilities required extensive renovations and were repositioned as “The Storage Company” with a new logo and brand identity. The transaction was financed with an acquisition loan from UBS Real Estate Investments, Inc. and equity was provided by a major institutional investor. After successfully repositioning the assets, Wharton Industrial sold the portfolio to an affiliate of Northwestern Mutual Life for approximately $56 million.

An affiliate of Wharton Industrial, Wharton Storage, assembled a portfolio of over 2,200 self-storage units from different sellers across three properties located in the Hamptons, New York. While in control of over 80% of the self-storage units in a high barrier-to- entry market, Wharton Industrial, who managed the properties and handled the integration of the assets, significantly raised rents and re-branded the facilities. The portfolio was ultimately sold to a NYSE REIT.